Say What?

Now that I have your attention, let me explain myself a bit. I’ve often discussed how I am not a frugal person. I’ve written how we are “spendy savers.” But, while not frugal, I can be QUITE cheap.

I don’t mind spending money on things I want to buy (duh), I don’t even mind spending money on bills (I actually really enjoy it), but I HATE spending money on “needs.” Examples of needs that I HATE spending money on: work shoes, light bulbs, eye glasses, laundry detergent, car maintenance, house maintenance and underwear.

About two years into our marriage Mr. Hodgepodge and I were putting laundry away when he discovered that half of my undies had holes in them. He was nonplussed about that and thus the phrase “we don’t wear holey underwear” came into fruition. It has now become a house hold motto and pretty much expands to anytime I’m being cheap. Mr.Hodgepodge puts up with A LOT of my crazy ideas to further ourselves financially. He basically allows me to take complete control of our finances, even when sometimes the things I do might be a bit nutty, but he definitely cuts me off when I cross the line from saving to being a cheapskate.

There was a “we don’t wear holey underwear” moment earlier today. We were putting dishes in the dishwasher when Mr.Hodgepodge came across my Blender bottle, with packing tape wrapped around the lid. He looked at me quizzically and started taking the tape off the lid. I quickly tried to stop him, explaining that there was a hole in the lid and the tape was keeping the liquid from leaking out. Before I could even complete my sentence, he paused…looked at me and said “do I even need to say it?”

No…no Mr.Hodgepodge you don’t….”The Hodgepodges don’t wear holey underwear…..”

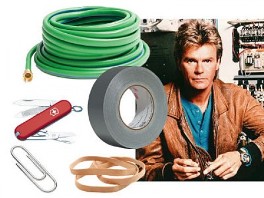

He then chucked my perfectly MacGyvered cup into the recycling bin! Knowing me well he also put it in the bottom of the recycling bin and then took it out to the garage. The nerve!

I’d like to say this story ends with me having a shiny new Blender bottle, but it does not. I’d also like to end this story with some sage advice about being “penny wise but a pound foolish” but I won’t do that either. The reality of it is we did go out to purchase a new Blender bottle, but we also had to make a few other “need” purchases while out: Allergy Meds and Shampoo. After picking up those items I could not bring myself to spend the 8 dollars on a new Blender bottle…what can I say…a tiger can’t change their stripes.

Smoothies out of a Nalgene bottle for me! Happy Saturday everyone!