I’m not even quite sure how to write this post as it almost seems wrong to write it in the first place. The last month has been a complete blur. My mother passed away last week after a long battle with cancer. She’s had one form of cancer or another for the past 14 years, but three years ago was diagnosed with terminal cancer. Even though we knew this was the inevitable, you can never truly be prepared for something like this. We had 2.5 years longer with her than we anticipated, but it still seemed too fast. My mom has always been a bit of an anomaly when it came to her cancer, she was a fighter and always got better against all odds. I think we had all come to believe that even with a terminal diagnosis she would be ok. If you remember back in June she came to visit me on the East Coast. I knew she seemed more run down than usual, but I chalked it up to her new chemo.

This past month, especially the past two weeks has taught me a LOT both personally, professionally and financially. Over the next several blog posts I will touch on all of these things.

I’ve discussed previously how I am a perfectionist…well, my mom is also a perfectionist, I definitely got it from her. While the last two weeks came faster than we anticipated, my mom had time to plan. She had an entire word document of everything that my brother and I needed to do in regards to her finances, bills, etc. She joked that she would be controlling the funeral arrangements from her grave. As I type this I’m currently sitting on hold with the water company, going through her step by step directions of everything that needs to be done. There have been a few snafu’s that I don’t think she anticipated (and would be so mad if she knew there had been a mistake) but ultimately everything is flowing as well as can be expected at this point.

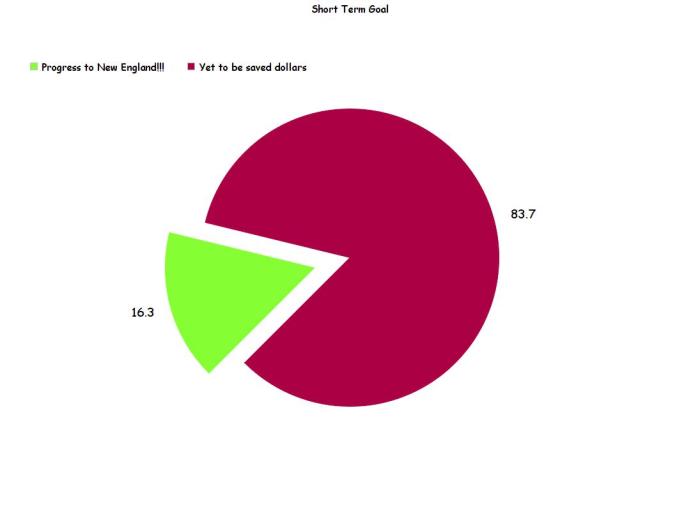

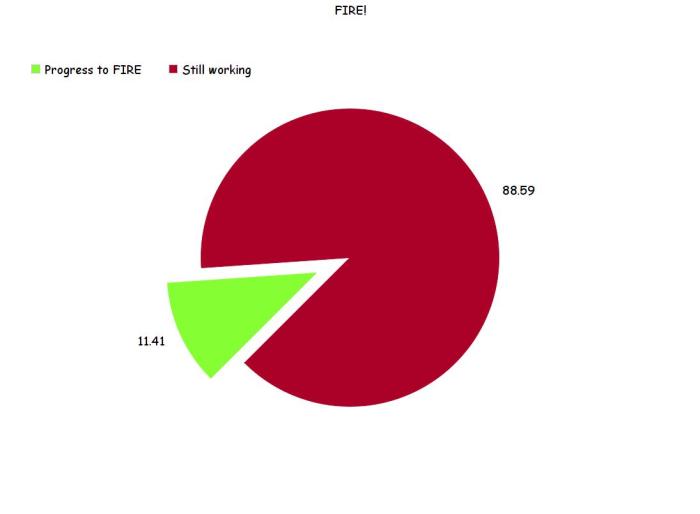

One of the big things learned through this process is how being financially secure makes EVERYTHING so much easier. I’ll discuss my mom’s estate in an upcoming blog, but I can tell you that Mr.Hodgepodge and I being financially secure made things much less complex. We were also extremely fortunate to have supportive employers who let us drop everything and just go when needed, which meant Mr.Hodgepodge flying back and forth from the Midwest to the East Coast.

I’ve discussed that I am in the Healthcare profession, more specifically I am a medical social worker. I work with families on a daily basis assisting with end of life decisions. I consider Grief and Bereavement an area of expertise, but I can now tell you that all of my professional training did not prepare me for my own grief experience. The complete fog that has been my life for the past month, was made less complex by not having to worry about finances. Being able to buy the most convenient flights and rental cars, without looking at cost was hugely important. My budget looks a mess and I have no idea what category to put “urn” under, but we were able to absorb all of the unplanned expenses. This certainly doesn’t change the heartache I feel, but it does take away at least one level of potential stress that could have been there.